Old vs New GST rates list 2025: Full list of items with revised rates effective from Navratri, September 22, 2025

Introduction

The Goods and Services Tax (GST), launched in 2017, was intended to simplify India’s complex indirect tax structure. However, over time, multiple slabs (0%, 5%, 12%, 18%, 28% + cess) created confusion and frequent disputes.

Now, in 2025, the 56th GST Council Meeting chaired by Finance Minister Nirmala Sitharaman has approved GST 2.0. This new regime reduces slabs, simplifies compliance, and cuts rates on hundreds of items. The new system will apply from September 22, 2025 (Navratri).

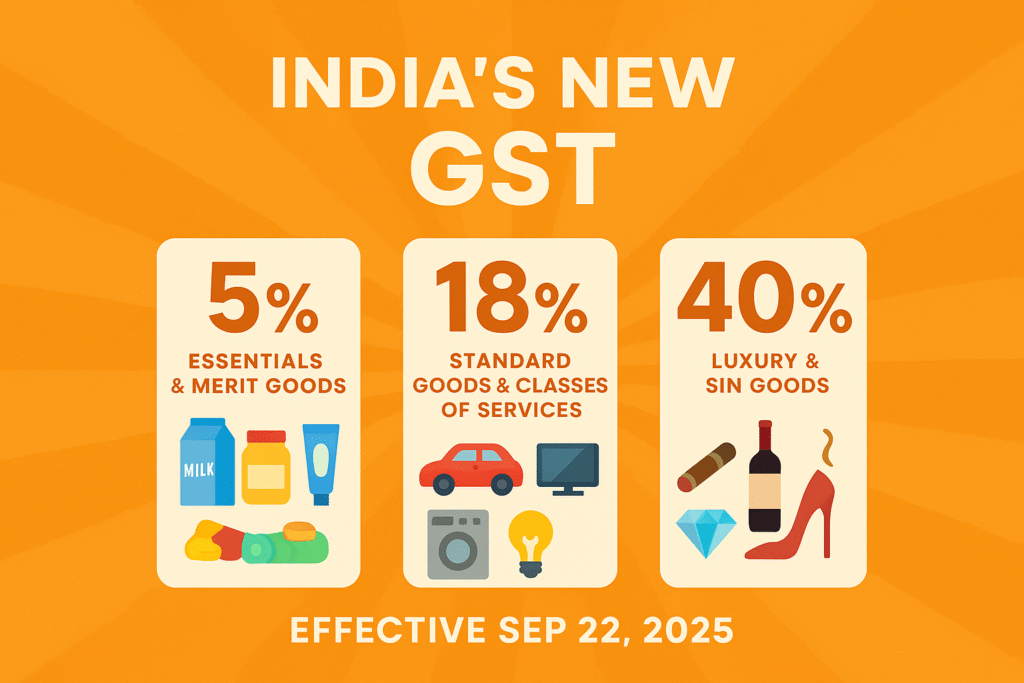

The old 5-slab structure has been replaced with just three slabs:

- 5% slab (essentials & merit goods)

- 18% slab (standard goods & services)

- 40% slab (luxury & sin goods)

5% or Nil Slab – Essentials & Merit Goods

Old Rate: Mostly 12% or 18%

New Rate: Reduced to 5% (or NIL for some)

- Packaged food (noodles, chocolates, biscuits, cereals) from 12%–18% to 5%

- Dairy products (paneer, butter, ghee, UHT milk) from 12% to 5%

- Personal care (soap, shampoo, toothpaste, talcum powder) from 18% to 5%

- Kitchenware & tableware from 12%–18% to 5%

- Bicycles, feeding bottles from 12% to 5%

- Stationery (notebooks, pencils, sharpeners, globes, maps) from 12%–18% to 5% or NIL

- Medical devices & life-saving drugs from 12%–18% to 5% or NIL

- Insurance (life & health) from18% to NIL

- Hotel rooms < ₹7,500 tariff from 12% to 5%

- Economy class flight tickets from 18% to 5%

18% Slab – Standard Goods & Services

Old Rate: 28%

New Rate: 18%

- Air conditioners, TVs, dishwashers, refrigerators from 28% to 18%

- Small cars (petrol/diesel up to 1200cc/1500cc) from 28% to 18%

- Motorcycles up to 350cc from 28% to 18%

- Commercial vehicles (buses, trucks, ambulances) from 28% to 18%

- Cement & construction materials from 28% to 18%

- Fertilizers & agricultural machinery from 12%–18% to 5%–18%

40% Slab – Sin & Luxury Goods

Old Rate: 28% + Cess (up to 22%)

New Rate: 40% flat

- Cigarettes & tobacco products from 28% + 22% cess to 40%

- Pan masala & gutkha from 28% + cess to 40%

- Aerated beverages from 28% + 12% cess to 40%

- Luxury cars, yachts, helicopters from 28% + cess to 40%

Key Implementation Timeline & Exceptions

- Effective Date: September 22, 2025 (Navratri Day 1).

- Tobacco & pan masala: Continue under cess regime temporarily until compensation fund settlement.

- MSME Ease: Simplified return filing & faster refunds included.

Why These Changes Matter

1. For Consumers

- Groceries, medicines, dairy, and personal care items are now much cheaper.

- Electronics and appliances are affordable ahead of Diwali shopping.

- Travel and insurance costs will go down.

2. For Businesses

- Simplified slabs (5%, 18%, 40%) reduce classification disputes.

- Lower compliance cost for MSMEs with easier GST returns.

- Boost to auto, construction, and FMCG sectors.

3. For Economy

- Expected short-term revenue loss of ₹48,000 crore, but higher consumption & lower inflation will offset it.

- Encourages Make in India and domestic manufacturing by reducing tax burden on essential industries.

Conclusion

- India’s GST 2.0 is not just a tax reform—it’s an economic reset. By making essentials cheaper, standardizing rates, and imposing higher taxes on luxury/sin goods, the government is aligning GST with both growth and social equity.

- Consumers will enjoy lower prices, businesses will find compliance simpler, and the economy is poised for a festive-season boost.